- Investment Research Partners

- Jan 13

- 18 min read

Executive Summary

Last year was defined, at least in part, by high levels of uncertainty driven by dramatic changes in trade policy, geopolitical tension, and the continued rise of artificial intelligence.

However, the economy and markets proved to be remarkably resilient despite the uncertainty.

In fact, many indices ended the year close to all-time highs as investors benefited from almost all asset classes rising throughout the year.

Against this backdrop we begin 2026, and in the second half of this piece we outline the issues that we believe will define the year to come.

2025 in the Rearview Mirror - Uncertain Times, Remarkable Resilience

The past year offered no shortage of surprises. Economic and market narratives shifted repeatedly as policy uncertainty, geopolitical tension, and rapid technological change shaped investor psychology. Consumer sentiment remained depressed for much of the year, as consumers struggled to digest a new administration, a historic reordering of global trade rules, the expansion of artificial intelligence, and the longest government shutdown in US history.

Yet despite the noise, 2025 ultimately reflected not only uncertainty, but also remarkable resilience—both in the underlying economy and across global asset markets.

I. A Year Defined by Policy Change & Shifting Domestic Priorities

Several developments contributed to a sense of structural uncertainty throughout 2025:

New Administration & Regulatory Reset

Early-year policy actions, including the “Liberation Day” tariff announcement in April and subsequent 90-day pause, sent shockwaves through markets and accelerated a reassessment of global supply chains and inflation expectations. These events created volatility that was both expected (the stock market fell on the news) and unexpected (the bond market also fell in unison) in the immediate aftermath.[1][2]

The Rise of DeepSeek as a Threat to US AI Supremacy

Chinese firm DeepSeek’s release of the R1 large language model in January 2025 sparked debate over whether the US continues to retain clear technological leadership. The AI investment cycle remained the defining economic and market force throughout the year, even as investors debated whether threats from Chinese competition and declining marginal returns on hyperscaling might mark the early stages of an AI-related valuation bubble.[3][4]

Fiscal Dynamics and the One Big Beautiful Bill (OBBB)

The combination of tariff revenue, deficit concerns, and new spending priorities created unusual fiscal crosscurrents in 2025. Markets were attentive to projections that OBBB-related investment incentives could boost growth in 2026, even as concerns about the US budget deficit persisted.[5] Highlighting concerns about long-term increases in government debt, Moody’s rating agency downgraded US Treasury debt, bringing it one notch below the coveted Aaa status, joining the other two primary rating agencies (S&P and Fitch), which downgraded the debt in 2011 and 2013, respectively.[6] Further complicating matters, the US Supreme Court heard oral arguments in November to determine whether the president’s use of emergency powers under the International Emergency Economic Powers Act includes the power to impose tariffs.[7] It is unclear how or if the US government will return the significant tariff revenue collected thus far should the tariffs be ruled illegal. As a result, we may see some 2025 tariff-related uncertainty and concerns about the deficit spill over into the New Year.

US Dollar Weakened & Geopolitical Tension Remain Elevated

In 2025, the US dollar recorded one of its sharpest first-half declines in decades, amplifying returns for non-US assets (both developed and emerging markets) and raising questions about the durability of the safe-haven premium historically attributed to the dollar and US Treasury Bonds.[8] Simultaneously, geopolitical tensions remained high, from continued Russian aggression to the intensifying competition with China for technological supremacy (and in early 2026, the US removal of Nicolas Maduro in Venezuela).[9]

The Longest Government Shutdown in US History

The multi-month government shutdown, which was the longest in US history, further weighed on sentiment in 2025. While ultimately resolved, the event highlighted the highly polarized environment in Washington and the struggle our elected officials face in reaching agreements. In addition, there were economic and logistical complications from the shutdown that lingered even after the government reopened. For example, government agencies were unable to collect standard data points on pricing and the labor market, resulting in delayed or missed economic reports, such as the Consumer Price Index (CPI), that market participants and the Federal Reserve rely on to make policy decisions, further muddying an already confusing economic picture.

The K-Shaped Economy

Despite relative economic and market strength (more on this in the next section), consumer sentiment was generally poor for much of the year. We believe there were several potential drivers of discontent in 2025:

Softening Employment Trends

Payroll gains moderated, job openings declined, and unemployment ticked up throughout the year —all signs of cooling in the labor market (Unemployment Rate currently stands at 4.4%).[10] While some explanations for letting employees go are typical business-as-usual reasons, the Department of Government Efficiency (DOGE) cuts and AI workforce disruption are more specifically tied to this moment in time (see the Bloomberg graphic below).

Sticky Inflation

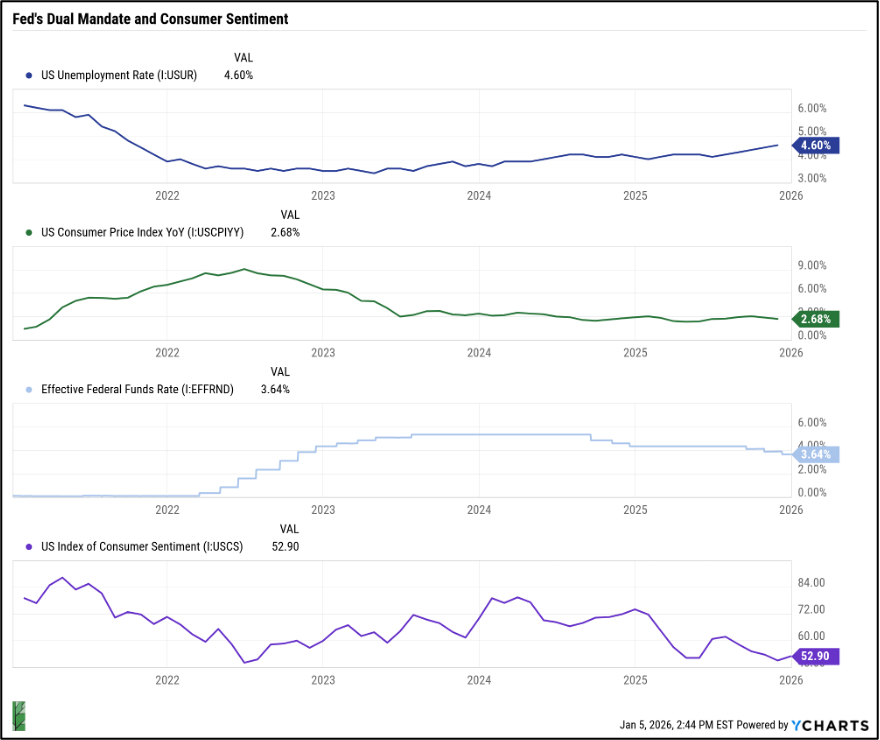

Although headline inflation continued its gradual decline, it remained well above the Federal Reserve’s (Fed’s) target of 2% in 2025 (see Consumer Price Index in green, below). Ultimately, concerns over labor market weakness prompted the Fed to reduce the Fed Funds rate over the final three meetings of 2025 (resulting in a total reduction of 0.75%).

However, the release of the December Fed minutes highlights significant differences of opinion among the voting members, with rare dissents from a few Fed voting members who leaned in both directions – one in favor of more cuts and two in favor of no change. Fed Chair Powell characterized the Fed funds rate as “within a range of plausible estimates of neutral,” potentially suggesting that a pause in further rate reductions may be appropriate to see how the recent rate cuts impact the economy.[11] As a result, the balancing act of the Fed’s dual mandate – maintaining full employment and price stability – will most likely be a topic to watch in 2026, as well.[12]

K-Shaped Economy

The “K-Shaped Economy”, a term coined by Peter Atwood (an economist, author, and William & Mary professor), attempts to describe the stark differences in perspective between individuals in higher-income brackets and those in middle- and lower-income groups. In general, individuals who are homeowners and investors have benefited from advancing markets and rising home prices in recent years. As for low-to-middle-income individuals, they are disproportionately impacted by the effects of higher inflation and lower affordability. Unemployment has risen (especially among recent college graduates), inflation remains above target, and they have not benefited from the rise in asset prices because they have far less exposure to stocks and real estate. This phenomenon, which incorporates the softening job market and higher inflation mentioned previously, may be part of the reason consumer sentiment remained at washed-out levels throughout 2025.[13]

Depressed Consumer Sentiment

The University of Michigan Consumer Sentiment Surveys remained depressed throughout 2025 (see Consumer Sentiment in purple, below), which is not surprising given the issues discussed above. For context, the sentiment reading at the end of 2025 (52.9) is very close to the lowest reading on record in the survey’s more than 70-year history (reading of 50 occurred in June 2022).[14]

High levels of uncertainty and change were certainly part of the story last year. As are the K-Shaped Economy, poor consumer sentiment, and the struggles of those in lower income brackets. However, there was more to the story of 2025.

II. But Also a Year Defined by Resiliency

Despite meaningful headwinds, several segments of the economy and market proved remarkably durable in 2025. After faltering in the first half, the economy regained momentum:

GDP Re-Acceleration

After contracting during the first quarter of the year, economic activity (as measured by Gross Domestic Product, or GDP) rebounded in Q2 and Q3 (see below). While the first and second quarter numbers were distorted by tariff-related uncertainty, the strong third quarter print points to a relatively solid underlying economy.[15]

AI-Driven Capital Expenditures

Capital spending related to artificial intelligence (AI) infrastructure remained a key contributor to economic growth, accounting for a disproportionate share of GDP expansion in 2025 (tech capex spending as a percent of GDP last year approached the spending on all of these major US infrastructure projects in total, see below).[16] Given the significant level of commitments from AI hyperscalers and the “win AI at all costs” approach outlined by the Trump administration in the recent Genesis Mission announcement, the spending appears far from over.[17]

The Genesis Mission announcement in November flew somewhat under the radar, but it is framed as the “Manhattan Project” for AI, seeking to “accelerate scientific discovery, strengthen national security, secure energy dominance, enhance workforce productivity, and multiply the return on taxpayer investment into research and development, thereby furthering America’s technological dominance and global strategic leadership.” To achieve that objective, the mission seeks to create a strategic alliance among government, academia, and the private sector to address problems across the following six focus areas: advanced manufacturing, biotechnology, critical materials, nuclear energy (fission and fusion), quantum science, and semiconductors/microelectronics. [18] Whether the Genesis Mission achieves its objective remains to be determined, but the administration makes it clear in the announcement that AI is a national priority.

Corporate Earnings Remain Impressive

Recent corporate earnings reports have been broadly positive, led by financial and technology companies, with year-over-year earnings growth of 13% for the third quarter of 2025, marking the 4th straight quarter of double-digit earnings growth. Analyst expectations also remain positive for the fourth quarter of 2025 and for 2026. Companies seem to be successfully navigating the volatile tariff environment, and profit margins are expected to improve.[19]

Given the uncertainty around trade and tariffs in 2025, the US economy, buoyed in part by massive AI capex spending, proved incredibly resilient throughout the year.

Market Resilience: 2025 Delivered Broad-Based Returns

2025 will likely be remembered as a year in which both risk-seeking and risk-mitigating assets delivered positive returns, an unusual combination (and a counterpoint to 2022, a year when almost nothing worked):

US Equities (as represented by the indexes in blue below) advanced meaningfully in 2025, despite a significant downturn amid tariff-driven uncertainty around Liberation Day. The Nasdaq Composite, an index focused largely on technology-related stocks, benefited from AI-linked mega-caps regaining their leadership role by the end of the year, roared back from Liberation Day lows to finish the year up over 21%. However, the S&P 500 (a proxy for large-cap stocks, up nearly 18%) and the Russell 2000 index (a proxy for small-cap stocks, up nearly 13%) also rebounded and posted strong annual returns.

Non-US Equities (as represented by indexes in green, below) benefited from dollar weakness and attractive valuations in 2025 and ended up easily outpacing US stocks in 2025. Both the MSCI EAFE and Emerging Markets indexes advanced more than 30% last year.

Fixed Income (as represented by indexes in purple, below) also had a strong year, though lagging the outsized returns of equities and some other asset classes. Both the Bloomberg US and Global Aggregate indexes ended 2025 up approximately 7-8%, driven, in part, by relatively attractive starting yields and a series of central bank rate cuts throughout the year.

Commodities largely followed suit in 2025, advancing alongside stocks and bonds. The Bloomberg Commodity index (in dark orange, below) climbed nearly 16% during the year. The index has many commodity subcategories, including energy, agriculture, precious metals, and industrial metals. Gold had a particularly strong year in 2025, ending the year up over 60% (as represented by the S&P GSCI Gold index, light orange, below). Several potential drivers – including global central bank purchases, concern about geopolitical uncertainty, and hedging against inflation – likely played a role in its advance.

Cryptocurrency was one of the few outliers last year, losing value over the course of 2025 (as represented by Bitcoin’s Price in red, see below). This came as a surprise to many, as the Trump administration has been seen as being pro-crypto.

Much like the resiliency exhibited by the US economy, the market also proved durable in 2025. While 2025 differed from previous years in many ways, one similarity does persist – AI remained the biggest driver of returns. As illustrated below, the eight largest hyperscalers and semiscalers have grown from approximately $3 billion in 2018 to nearly $18 billion at the end of 2025. As a result, those eight stocks now represent nearly 20% of the MSCI World and 15% of the MSCI ACWI indexes.[20]

Conclusion

In many respects, 2025 was defined by both uncertainty and resilience, by policy surprise and economic adaptability, and by the market moving from a sharp correction to broad-based asset appreciation.

Periods like this can challenge investors, especially when long-standing assumptions are tested. But as the year demonstrated, staying invested, maintaining diversification, and grounding decisions in fundamentals rather than headlines proved beneficial.

With that, it is time to look at the road ahead as we enter 2026.

2026 Outlook

As we mentioned in the 2025 review, we ended last year in a relatively good place from an economic and market perspective. The US economy weathered the uncertainties of last year remarkably well, and as a result, we begin this year on relatively stable ground. Unemployment has crept up, inflation is a little higher than desired, and consumers are pessimistic, as we described. However, top-line economic growth remains solid, corporate earnings are healthy, and equity markets are near all-time highs.

As we begin the new year, we have identified three potential themes that we believe will drive returns in 2026:

AI & Market Concentration

Deficit & Inflation

Beneath the Surface

AI & Market Concentration

We remain constructive on equities in general, but concerns exist regarding the potential for a market pullback in 2026 following three straight calendar years of robust returns, particularly for US equities. S&P 500, which is a proxy for US large-cap equity exposure, has become increasingly concentrated in large technology companies. As shown in the chart below, the top ten companies (mostly in the tech sector) now account for more than 40% of the index. [21]

As you can see above, concentration at the top has really ramped up since OpenAI launched ChatGPT near the end of 2022. In fact, a recent JPMorgan piece analyzed the index and found that, “65%-75% of S&P 500 returns, profits and capital spending since the launch of ChatGPT in 2022 have been derived from 42 companies linked to generative AI. In other words, the generative AI investment theme has smothered the rest of the US equity market.”[22]

We remain optimistic that AI will continue to advance and become as ubiquitous as cell phones and the internet in the future. However, we are hesitant to invest too heavily in the handful of AI-related stocks that have led the way thus far, remembering this quote from Bill Gates, “We always overestimate the change that will occur in the next two years and underestimate the change that will occur in the next ten.” [23] As we pointed out in a previous piece, we believe AI is another example of a technological rising tide that has the potential to lift all boats, so rather than continue to simply pour money into large tech names that have already appreciated significantly, we look for companies that may benefit in the next phase.[24]

Biotechnology companies stand at the intersection of multiple potential long-term trends. For example, they may be positioned to benefit from continued merger and acquisition activity as large pharmaceutical and healthcare companies seek to replenish and diversify their drug portfolios by acquiring innovative therapies rather than relying solely on in-house research and development. As patent expirations pressure revenues at large pharma firms, acquiring or partnering with smaller biotech companies can offer a more efficient way to access novel platforms, differentiated science, and late-stage assets, often at a lower risk-adjusted cost than internal development. At the same time, potential cuts to funding at institutions such as the National Institutes of Health could slow early-stage, publicly funded biomedical research, reducing the flow of new discoveries and potentially increasing the strategic value of established biotech companies with proprietary platforms, clinical expertise, and internal R&D capabilities.

Against this backdrop, emerging technologies such as artificial intelligence and, over time, quantum computing may help offset some of these headwinds by improving target identification, accelerating drug discovery, optimizing clinical trial design, and reducing development costs. Collectively, these dynamics could reinforce the competitive position of well-capitalized biotech firms and make differentiated innovators increasingly attractive acquisition targets for larger healthcare companies seeking growth and pipeline sustainability.

As shown in the chart below, biotech stocks benefited from a rebound in sentiment in 2025 and produced strong returns after several difficult years. We believe many biotech companies remain relatively undervalued, despite their recent run, and will benefit from the long-term structural tailwinds discussed above.

Mid- and Small Cap Stocks also look relatively attractive for two primary reasons. First, their valuations are more attractive than their large-cap counterparts. This is not necessarily a reason to buy this group of companies, as valuation disparities can persist for a long period of time, and potentially for good reasons. However, as we highlighted in our 2025 outlook piece, we believe that artificial intelligence will lead to broad productivity gains across industries as the technology is applied to drive efficiency gains.[25] For example, industrial companies may benefit from increased use of robotics, financial services companies from agentic AI to process and monitor transactions, and healthcare companies from more efficient processing of medical scans and patient records. These three industries make up more than 50% of the small-cap market.[26]

Deficit and Inflation Concerns

Both of these issues were concerns in 2025, and we believe they could emerge as market drivers in 2026, as well. While inflation gradually retreated throughout 2025, it remains above the Federal Reserve’s 2% target. Additionally, we discussed the enormous amount of spending by AI hyperscalers in the 2025 review. However, bringing all of these new AI data centers online requires massive amounts of power (see below). As demand for power increases rapidly in the coming year, we believe electricity prices may rise, putting upward pressure on inflation.

There are arguments to be made for inflation falling, and they should not be dismissed. Access to oil from Venezuela may increase supply and reduce oil prices, inflation related to the tariff announcement may begin to dissipate, and AI-related productivity gains should be disinflationary overall. We find all of these arguments plausible, and we are not disputing those potential outcomes.

However, the quote from Morgan Housel comes to mind, “A lot of financial debates are just people with different time horizons talking over each other.” We remain wary of inflation near-term because we believe the increase in electricity demand is immediate, while we anticipate the disinflation arguments to take longer to materialize.

The US deficit was another issue discussed during the approval of the OBBB last year (when Moody’s downgraded the US Treasury debt). However, the topic has received very little press since then, despite the situation not improving (see below).[27] We would not be surprised if this subject resurfaces in 2026.

Given our concerns related to these two topics, we recommend the following portfolio positioning:

Fixed income is the asset allocation component most susceptible to the risks described above. We are currently slightly underweight bonds in client portfolios, given the potential for renewed upward pressure on long-term interest rates driven by persistent inflation risks and elevated government debt and fiscal deficits. While inflation has moderated from recent peaks, structural forces such as higher wage growth, supply-chain realignment, and increased government spending may limit the ability of inflation to return to consistently low levels, increasing the risk that interest rates remain higher for longer. At the same time, large and growing fiscal deficits require substantial US Treasury issuance, which can put upward pressure on yields as the market absorbs the additional supply, particularly if demand from traditional buyers weakens. In this environment, longer-duration bonds are especially vulnerable to price declines, and the income provided by fixed-rate securities may be insufficient to fully offset capital losses.

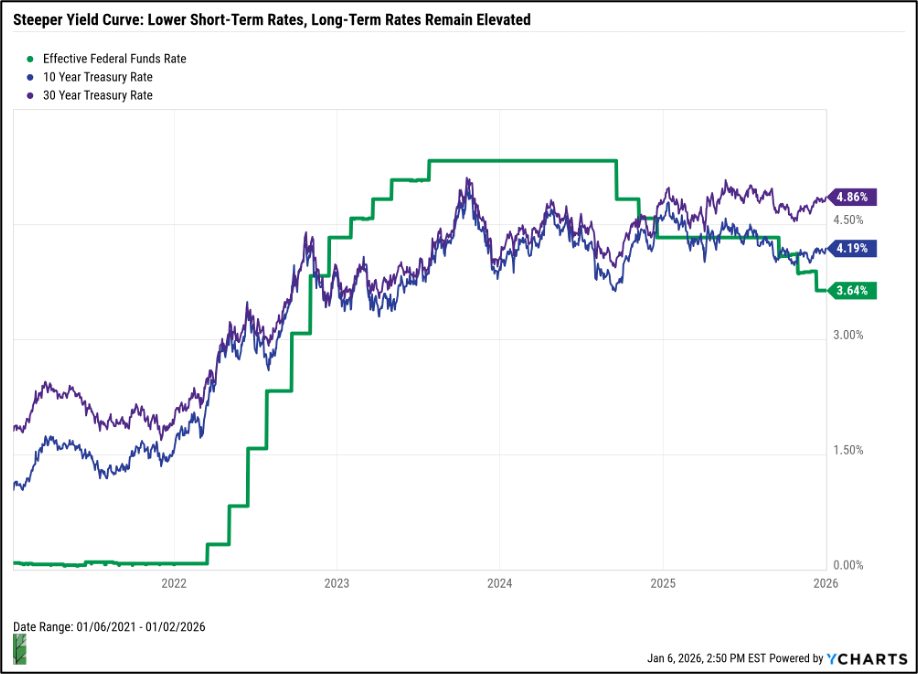

While long-term rates are heavily influenced by these inflation, supply, and demand market dynamics, short-term interest rates are driven more by the Federal Reserve (Fed) and related market expectations. As we discussed in the 2025 recap, the Fed reduced short-term target interest rates by a total of 0.75% in the last few months of the year, and the path of future rate policy is still expected to be gradually lower in 2026. However, there is significant uncertainty about the timing given lingering concerns about inflation, which remains stubbornly above the Fed target.

To complicate matters further, Jerome Powell’s term as Fed Chairman ends in May, and President Trump is expected to announce a new Chair that may be more willing to pursue rate cuts more aggressively (although the Chair still represents just one vote out of 12 voting members of the Committee). This may boost financial assets and economic growth; however, it may also spur another round of painfully high inflation, which harms consumers in the long run. For bond markets, the outcome may be a continuing steepening of the yield curve (i.e., lower short-term rates, long-term rates remaining elevated or moving higher), as we saw in 2025.

As a result, we believe an underweight to bonds is prudent, allowing portfolios to reduce interest-rate sensitivity while maintaining flexibility to reallocate capital if valuations improve or yields reach more compelling levels.

Commodities represent another alternative asset class that we recommend as a diversifier to traditional stocks and bonds. Commodities is a broad term that encompasses a diversified basket of assets, including energy inputs (oil and gas), precious metals like gold and silver, industrial metals like copper, and agricultural products such as beef, grain, and corn. In a world of rising demand for energy and industrial metals to support the AI infrastructure buildout, we believe that commodity prices have the potential to continue rising. In addition, precious metals such as gold and silver can act as safe-haven assets when perceived risk increases (see the next section). Commodities have also historically provided benefits to portfolios through lower correlation to traditional assets like stocks and bonds, potentially helping to increase overall portfolio diversification and smooth returns.

Foreign Stocks can provide meaningful diversification benefits within a portfolio by reducing reliance on US economic conditions, policy outcomes, and market leadership, while increasing exposure to different growth drivers and business cycles. In particular, foreign equities may offer an added layer of protection in a declining US dollar environment, as returns from international holdings can be enhanced when translated back into dollars and local-market revenues are often less exposed to US-specific inflation or interest-rate dynamics.

From a valuation perspective, many international markets trade at lower average multiples than the S&P 500, reflecting more conservative earnings expectations, sector composition differences, or prolonged periods of underperformance, which may create opportunities for higher prospective returns if fundamentals improve or sentiment normalizes. Additionally, major foreign indices have significant exposure to sectors such as healthcare, industrials, and financial services, where advances in artificial intelligence is increasingly being applied to improve productivity, efficiency, and decision-making. As AI adoption broadens beyond US-centric technology companies, foreign firms with strong competitive positions in these industries may benefit from improved margins and growth prospects, supporting the case for international equities as a complementary and diversifying component of a long-term investment portfolio.

Beneath the Surface

Despite strong market performance and resilient economic data in parts of 2025, a growing number of pressures are visible across global financial, economic, and geopolitical systems. Elevated debt levels, ongoing geopolitical conflicts, shifting trade alliances, strained US-China relations, and signs of slowing economic momentum coexist with equity markets trading near all-time highs. Within the US, polarization remains high, strain on the lower-income earners grows (see K-Shaped discussion above), and both the market and economy seem to be overly reliant on AI growth.

While none of these risks alone is unprecedented, their simultaneous presence suggests increasing pressure within the global system—conditions that warrant careful consideration as we look ahead to 2026.

Alternative Investment strategies, such as long/short equity, hedged equity, market-neutral, and managed futures approaches, may play a more meaningful role in portfolio diversification in an environment where equities and bonds have become more highly correlated and volatility has the potential to pick up. For example, see the rolling three-year correlation of bonds and stocks below. The increase in correlation indicates that stocks and bonds are moving in the same direction more often, potentially challenging bonds’ role as a diversifier for stocks in portfolio construction.[28]

Conclusion

We begin 2026 with equity markets near all-time highs, three years into a rally that began back in 2023. Both the market and the economy were resilient throughout last year despite uncertainty and change.

However, we also enter 2026 with at least as many big questions as answers. We anticipate a potential tailwind from the One Big, Beautiful Bill early in the year, and spending on AI datacenters will continue to drive economic activity. Yet, a number of uncertainties remain, and it is difficult to know whether the resilience the economy and market have exhibited will continue.

As a result, we recommend a balanced and diversified approach. We are leaning away from some of the risks we see, but we’re also leaning into opportunities in some of the under-loved parts of the market, as well (see below).

Theme | Portfolio Rationale |

Emphasis on diversity within equities | Underweight S&P 500 exposure due to high valuations, market concentration in large technology companies in favor of Equal Weight Index, Dividends, International Equities |

Alternative Assets | Low correlation, reduced volatility, downside protection, tactical flexibility |

Shorter Bond Duration | Uncertainty in long-term interest rates, growing deficit |

Commodities | Inflation hedge, geopolitical risk diversifier, real asset exposure, energy transition |

Biotech | Uncorrelated economic drivers, demographic tailwinds, M&A potential, positive impact on society |

We appreciate your continued trust and welcome the opportunity to speak with you in greater detail in the context of your specific situation.

[1]Source: https://www.bloomberg.com/news/articles/2025-03-17/trump-s-trade-wars-tip-world-to-slower-growth-faster-inflation

[4] Source: https://www.bloomberg.com/news/articles/2026-01-04/is-the-ai-boom-a-bubble-waiting-to-pop-here-s-what-history-says

[9] Source: https://www.bloomberg.com/news/articles/2026-01-05/maduro-appears-in-us-courtroom-to-face-narco-terrorism-charges?srnd=homepage-americas

[10] Source: YCharts

[13] Source: https://news.wm.edu/2025/11/20/wm-professor-brings-k-shaped-clarity-back-to-market-discussion/

[14] Source: YCharts

[16] Source: https://am.jpmorgan.com/content/dam/jpm-am-aem/global/en/insights/eye-on-the-market/smothering-heights-amv.pdf

[19] FactSet as of December 19, 2025

[20] Source: https://am.jpmorgan.com/content/dam/jpm-am-aem/global/en/insights/eye-on-the-market/smothering-heights-amv.pdf

[21] Source: S&P 500 as of December 2025

[22] Source: https://am.jpmorgan.com/content/dam/jpm-am-aem/global/en/insights/eye-on-the-market/smothering-heights-amv.pdf

[25] Reference: https://www.investmentresearchpartners.com/post/irp-2025-outlook-a-new-technological-revolution-takes-shape-1

[26] Source: YCharts as of December 26, 2025; 17% financial services, 16% industrial, 19% healthcare of the iShares Russell 2000 ETF (IWM).

[27] Source: Congressional Budget Office, https://ratings.moodys.com/ratings-news/443154

[28] Source: YCharts as of November 30, 2025. Bonds represented by iShares US Aggregate Bond ETF (AGG), stocks represented by iShares S&P 500 ETF (IVV)

Important Information

All investments contain risk and may lose value. Past performance is not an indication of future performance. Information contained herein has been obtained from sources believed to be reliable but not guaranteed. This material has been distributed for informational purposes only and should not be considered as investment advice or a recommendation of any particular security, strategy or investment product.

Statements concerning financial market trends or portfolio strategies are based on current market conditions, which will fluctuate. There is no guarantee that these investment strategies will work under all market conditions or are appropriate for all clients and each client should evaluate their ability to invest for the long term, especially during periods of downturn in the market. Outlook and strategies are subject to change without notice.

Certain third-party sources cited in this material may require a paid subscription or may otherwise be located behind a paywall. If you would like more information regarding any cited source, please contact IRP and we will provide additional details upon request.

Click below to watch our 2026 Market Outlook video